The definitions of these two phrases have become all the more important after the letter many people received regarding the sale of 8 POA lots to one resident at, below, or slightly above tax value. To understand how rare this is, one must understand the difference.

Tax value is the value assigned by your local government for tax purposes. Tax value is typically significantly below market value.

Market value is the value your home would sell for if it were placed on the market. This value is typically determined by a Realtors Comparable Market Analysis (CMA) or Brokers Price Opinion (BPO).

The shortfall between tax value and market value is exacerbated in a sellers’ market like the one we experienced in 2022 and 2023. In the case of these 8 lots, the difference between tax value and the market value (the sold price) ranged from a low of 167% of tax value to the high of 420% of tax value.

The explanation for the sale of these lots given by John Bell at the April meeting alluded to the fact that it was normal to sell at tax value and that improvements had been made to these properties, resulting in the substantial profit of over $80,000 the resident made. If one looks at the dates of these sales, all were sold within 6 months, with 5 out of 8 properties sold in less than 2 months and one within two weeks. That would mean either very minimal improvements were made or, most likely, none at all. Important to note is that none of these sales are mentioned in any of the Board meetings or referred to in any Board minutes. According to our covenants, all contracts for sales must be signed by two board members. Were the contracts signed by two board members? Which two? Who decided to sell the lots at, below, or slightly above tax value? Why would the POA want to get any less for our properties resulting in significant loss for us?

Evidence provided by the Board to answer these questions would certainly assist the community in understanding, however the Board continues to remain silent. This seems to be following a troubling pattern.

Response is to this video clip from John Bell

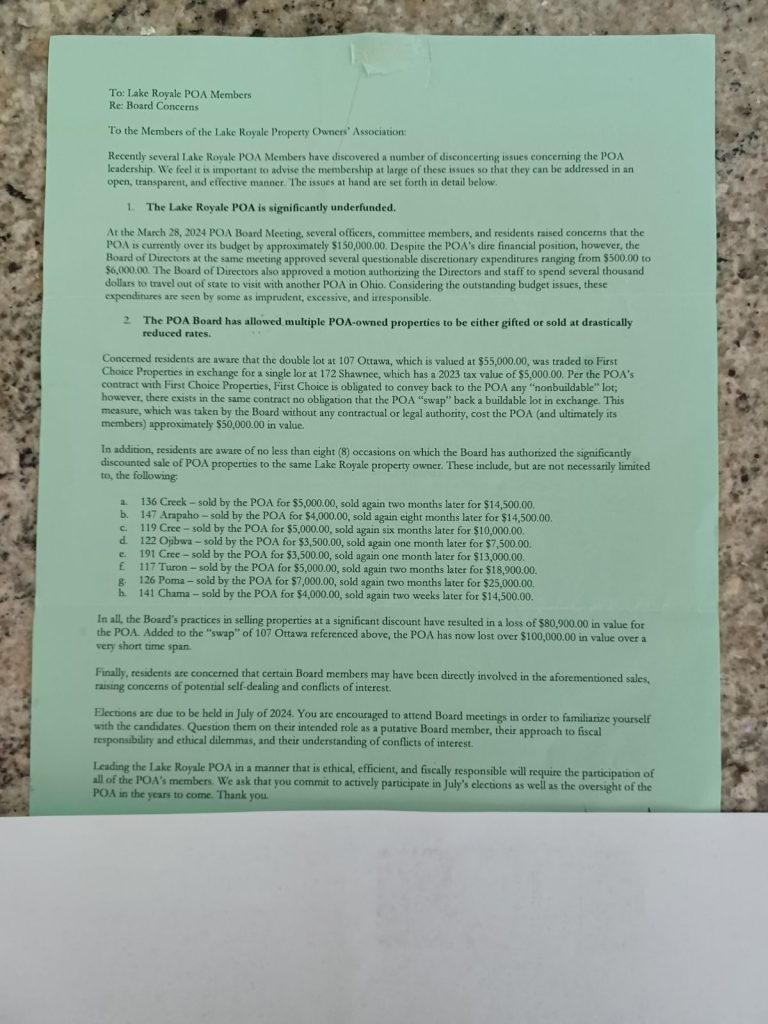

The letter everyone received